Why the U.S. Financial System Is Riskier Than It Looks in 2025

America used to be a strong and steady leader in global finance. Today, that stability feels more and more uncertain. While the headlines often focus on rising national debt, trade disputes, or political tensions, another danger lurks deeper within the financial system. And surprisingly, it doesn’t come from Wall Street’s usual suspects.

A New Breed of Financial Giants

Forget the old image of big banks steering the economy. Over the past decade, a new wave of financial powerhouses has quietly taken over. Firms like BlackRock, Apollo, Citadel, Blackstone, Jane Street, KKR, and Millennium have grown rapidly, moving from the shadows into the spotlight.

These firms don’t look like traditional banks. Yet, they control trillions in assets and play an outsized role in the global economy. They invest, lend, trade, and innovate at a scale never seen before. While they’ve brought fresh energy and new tools to finance, they also carry risks that regulators and markets are only starting to understand.

Why This Shift Matters

Instagram | fortune500 | The combined assets of Apollo, Blackstone, and KKR in private markets have soared to $2.6 trillion.

Private market firms such as Apollo, Blackstone, and KKR have exploded in size. Together, they manage around $2.6 trillion—nearly five times more than they did ten years ago. By contrast, big banks saw their assets grow by just 50% in that same period.

These firms aren’t just investing money—they’re issuing annuities, financing corporate loans, and increasingly replacing banks in many areas. For instance, Apollo alone lent $200 billion last year, outpacing the combined loan growth of major banks.

Meanwhile, trading firms like Jane Street are matching or even outperforming the biggest names on Wall Street. In 2024, Jane Street earned as much from trading as Morgan Stanley.

Technology, Innovation, and Opportunity

One reason for this transformation? Regulation. After the 2008 financial crisis, governments made banks safer by forcing them to hold more capital. That opened the door for agile firms with fewer rules and more appetite for innovation.

The results have been impressive. American finance has become creative and faster. It channels money toward new technologies, like artificial intelligence and data center infrastructure. That fuels economic growth and draws in global investment. Foreign holdings of US securities have doubled to $30 trillion in just ten years.

In some ways, this system is even more secure. Traditional banks can face runs when depositors panic. Newer firms often rely on locked-up capital, which is harder to withdraw quickly.

But There’s a Flip Side

Despite all the growth, this new system isn’t risk-free. In fact, it hides serious vulnerabilities.

These modern financial firms still resemble banks in certain ways. Life insurance policies, for example, can be hard to cash out early, but if confidence drops, policyholders might rush to withdraw. That’s the kind of chain reaction that can lead to trouble.

Moreover, these firms are deeply interconnected with traditional banks. Since 2020, bank loans to non-bank financial institutions have increased to $1.3 trillion. Banks also lend heavily to hedge funds, with exposure jumping from $1.4 trillion to $2.4 trillion in just a few years.

The Transparency Problem

One of the main issues is the absence of transparency. Public stocks and bonds are priced constantly, giving investors a real-time view of market conditions. But private assets are much harder to value. This opens the door to mispricing, which might not be corrected until it’s too late.

Financial history teaches that flashy new tools can fail spectacularly when stress hits. Often, nobody knows where the weak points are until they break. That’s especially true for systems that haven’t been tested in a real crisis.

The Trump Factor and Global Uncertainty

Instagram | realdonaldtrump | With government debt, shifting trade policies, and Trump’s re-entry, political risk is rapidly increasing.

Now add political risk. The government’s growing debt worries investors worldwide. Trade policies keep changing. And with President Donald Trump back in the spotlight, uncertainty is rising quickly.

Trump’s stance on tariffs and international alliances causes conflict. His views on institutions and the rule of law add to the unease. Even the idea of financial bailouts—like those during the 2008 crisis—feels murky. Would the same support extend to hedge funds or private equity titans? Probably not without controversy.

As Trump reshapes America’s economic policies, the financial system finds itself in uncharted territory. This uncertainty, combined with new types of risk, is making American finance more fragile than most people realize.

The Next Crisis

A crisis could start in many ways—a sudden revaluation of private assets, unsustainable debt under rising interest rates, or a rush on life insurance products. Even a shift in foreign investor sentiment could trigger a broader sell-off.

Whatever the spark, one fact stands out: the current financial system hasn’t been truly tested in a high-stress scenario. If pressure hits, regulators may be left improvising emergency responses. And with public resistance to propping up wealthy institutions, political fixes could be slow or blocked entirely.

American finance remains a global leader in speed and adaptability. But that edge brings exposure to new and unfamiliar risks. Managing them requires awareness and vigilance—from institutions, regulators, and everyday investors alike.

This isn’t a repeat of 2008. It’s unfamiliar territory – and unfamiliar doesn’t necessarily mean less dangerous.

More in Finance

-

`

US Opposes Hezbollah Ally’s Appointment to Lebanon’s Finance Ministry

The United States is actively pressuring Lebanese officials to block Hezbollah and its allies from selecting the country’s next finance minister....

February 12, 2025 -

`

Ed Sheeran Becomes the First International Artist to Perform in Bhutan

Ed Sheeran has achieved a groundbreaking milestone in his music career. The “Bad Habits” singer, 33, became the first international artist...

February 5, 2025 -

`

New Jersey Issues Warning to 11,000 Businesses for Selling Flavored Vapes

In New Jersey, flavored vape products are illegal, but thousands of businesses continue to violate the law. According to Attorney General...

January 29, 2025 -

`

Why Prince Harry and Meghan Markle Hide Their Children’s Faces Online

Prince Harry and Meghan Markle remain two of the most talked-about public figures, yet their approach to sharing details about their...

January 22, 2025 -

`

Why Are Innovation Hubs Crucial for Entrepreneurial Success?

Innovation hubs are transformative spaces that empower entrepreneurs by providing the resources, mentorship, and collaborative environments needed to turn their ideas...

January 14, 2025 -

`

How to Finance an ATM Business in 3 Easy-to-Follow Steps

Starting an ATM business can be a fantastic way to earn passive income, but the first hurdle is figuring out how...

December 19, 2024 -

`

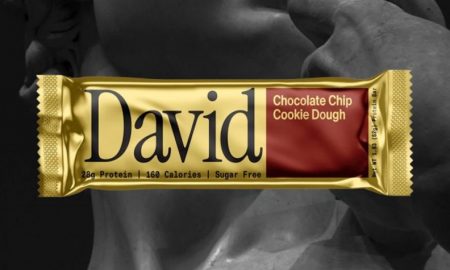

Former RXBar CEO Peter Rahal is Betting Everything on New Protein Bar Startup, David

Peter Rahal, the visionary entrepreneur behind RXBar, is back with a bold new venture. After selling RXBar to Kellogg’s for a...

December 15, 2024 -

`

Can investing in Nvidia Still Offer Value After Its Explosive Growth?

This year, Nvidia has been one of the stock market’s most impressive performers. Starting at $50 per share (split-adjusted) in January,...

December 6, 2024

You must be logged in to post a comment Login